JPMorgan CISO says three trends play a role in how he protects the banking giant

![]()

Pat Opet, the global chief information security officer at JPMorganChase, says three trends today play a role in how his team protects America’s biggest bank.

The first is that the bad actors have gotten savvier. This year alone, cyberattacks have stung big industries ranging from healthcare to car dealershipsto telecommunications giants. The average cost of a data breach in 2024 rose 10% to a record high of $4.9 million, according to IBM and independent researcher Ponemon Institute.

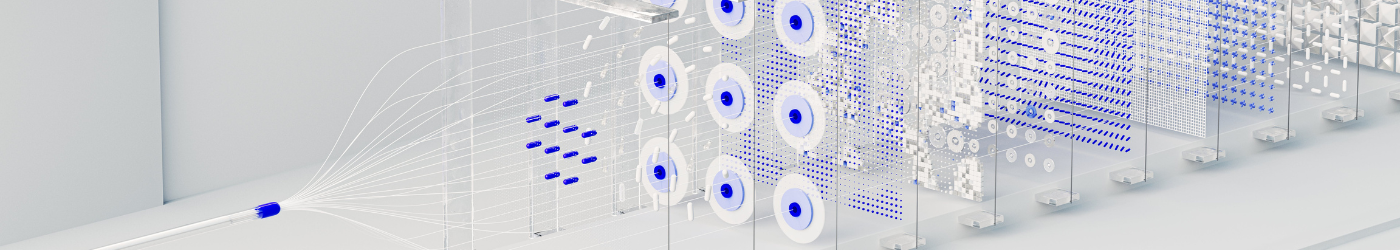

Secondly, there’s the increased reliance on cloud-based, software as a service (SaaS) applications, which have proliferated in popularity in recent years and saw an especially strong surge of adoption as companies embraced remote work during the pandemic. “All these changes in technology creates the opportunity for weakness or failure if companies aren’t diligent in how they mature these capabilities to make them available to employees,” says Opet.

Related Articles

- The convergence of SaaS and AI: Trends, opportunities and challenges

- Bridge the Talent Gap: Expert Resourcing Solutions for IT Success

- Comprehensive IT Support Services for Businesses

- Award Winning IT Services – Get a Free Assessment

- First operating system for quantum networks paves the way for practical internet applications